Table of Contents

Travel trailers in the USA typically depreciate 15-25% in the first year, then 5-10% annually. Quality brands, proper maintenance, and popular layouts significantly boost resale prices. In today’s softening market (2024-2025), maintenance records, brand reputation, and strategic pricing determine your selling success. BlackSeries leverages off-road durability and niche buyer demand to support long-term value retention.

What Is Travel Trailer Resale Value?

Resale Value vs. Depreciation: The Key Difference

Resale value represents the actual dollar amount you can expect to receive when selling your travel trailer in the secondary market. Depreciation, on the other hand, measures the loss in value from your original purchase price over time.

Here’s the simple formula: Original Price – Current Market Value = Total Depreciation

Most RVs lose approximately 20% of their value the moment they leave the dealership lot. This immediate depreciation reflects the difference between retail markup and actual market value, similar to new cars.

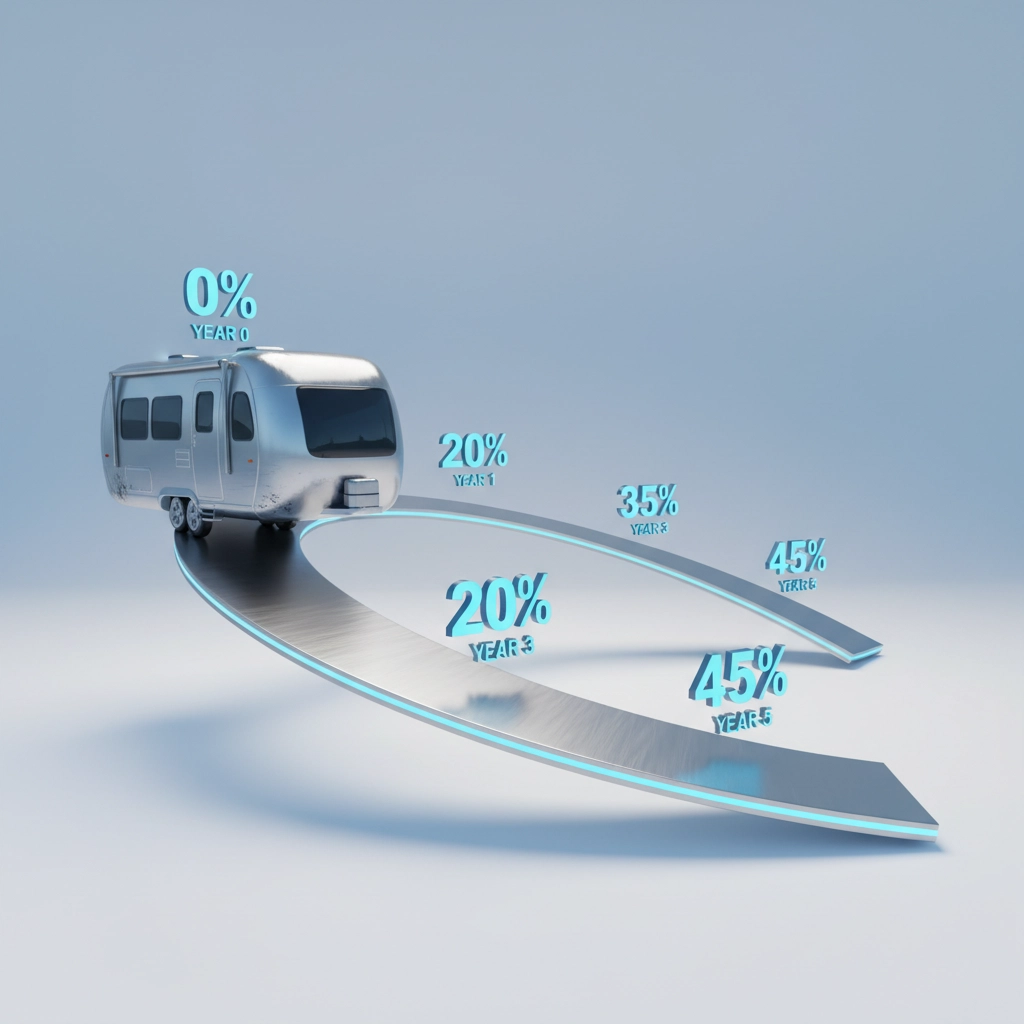

The U.S. Travel Trailer Depreciation Curve

According to industry data, travel trailers follow a predictable depreciation pattern:

- Years 2-5: Continue depreciating 5-10% annually

- 5+ years: Depreciation curve flattens as trailers reach their “floor value”

J.D. Power research indicates that quality travel trailers typically retain about 60% of their original value after five years, outperforming many other RV categories.

Current U.S. Used Travel Trailer Market Snapshot

2024-2025 Market Trends

The used travel trailer market has experienced notable shifts in recent years. Following the pandemic-driven RV boom, the market has normalized with increased inventory and more selective buyers.

Key market indicators for 2024-2025:

- Increased inventory levels leading to longer selling times

- Price-conscious buyers demanding better value propositions

- Quality differentiation becoming more important than ever

- Off-road and specialized trailers maintaining stronger demand

According to Black Book data, towable RV auction prices have softened from previous highs, with average selling prices declining from approximately $20,138 to $18,736 year-over-year.

What This Means for Sellers

In today’s market, three factors separate successful sales from stagnant listings:

- Competitive pricing based on actual market comparisons

- Excellent condition with documented maintenance

- Clear differentiation through features, brand, or specialization

Average Depreciation Rates for Travel Trailers

Industry-Standard Depreciation Timeline

Travel Trailers vs. Other RV Types

Travel trailers generally hold value better than motorhomes:

- Class A motorhomes: 36% depreciation after 5 years

- Class B & C: 37-38% depreciation after 5 years

- Travel trailers: Typically 37% depreciation, but premium brands perform significantly better

The advantage comes from lower mechanical complexity and reduced maintenance costs compared to motorized RVs.

Best Travel Trailer Brands for Resale Value

Premium Brands Leading Resale Performance

Several manufacturers consistently rank highest in resale value retention:

Airstream – The undisputed leader in travel trailer resale value, often retaining 60-70% of original value after five years due to iconic design, aluminum construction, and cult following.

Forest River & Jayco – These volume manufacturers offer strong dealer networks and parts availability, supporting resale confidence.

Winnebago – Leveraging motorhome brand strength in the towable market with quality construction and dealer support.

Specialty Off-Road Brands – Including BlackSeries, these niche manufacturers serve dedicated audiences willing to pay premiums for specialized capabilities.

Common Characteristics of High-Resale Brands

- Strong brand recognition and customer loyalty

- Quality construction materials and methods

- Extensive dealer networks for service support

- Clear market positioning and target audience

BlackSeries: Off-Road Niche Value Retention

The Off-Road Advantage

BlackSeries occupies a unique position in the travel trailer market through its focus on off-road capability and overland travel. This specialization creates several value-retention advantages:

Specialized Construction = Longer Lifespan

- High-strength steel chassis designed for rough terrain

- Independent suspension systems that outperform conventional axles

- Premium off-road suspension components engineered for durability

Niche Market Demand

The growing overlanding and off-road camping community represents a dedicated buyer base willing to pay for proven capability. Unlike mass-market trailers, off-road units serve specific needs that standard RVs cannot fulfill.

Durability as Environmental Responsibility

Longer-lasting construction means fewer trailers entering landfills, appealing to environmentally conscious buyers who view durability as sustainability.

Value Retention Factors for BlackSeries Owners

- Document all off-road adventures and terrain conquered

- Maintain detailed service records, especially suspension and chassis components

- Preserve original off-road equipment and accessories

- Target marketing toward overlanding and adventure communities

Key Factors Affecting Travel Trailer Resale Value

Brand Recognition and Build Quality

Brand reputation significantly impacts buyer willingness to pay premium prices. Established manufacturers with proven track records command higher resale values through buyer confidence in parts availability, service support, and construction quality.

Age, Usage Patterns, and Maintenance History

While age affects all RVs, usage patterns matter more than simple calendar time. A well-maintained trailer used primarily on paved roads will command higher prices than a neglected unit, regardless of age.

Complete maintenance documentation serves as proof of responsible ownership and can justify premium pricing.

Floor Plan and Market Demand

Certain layouts maintain stronger resale appeal:

- Family-friendly bunkhouse designs

- Lightweight models towable by SUVs

- Off-road capable units for adventure travelers

- Compact designs for urban storage

Market Timing and Economic Conditions

Seasonal demand patterns affect pricing, with early spring typically offering the strongest seller’s market as families plan summer adventures.

Condition and Presentation

Physical condition dramatically impacts resale value. Key areas buyers scrutinize include:

- Roof and sealing integrity

- Interior wear and cleanliness

- Mechanical systems functionality

- Exterior appearance and damage

How to Maximize Travel Trailer Resale Value Before Selling

30-Day Pre-Sale Preparation Checklist

Week 1: Deep Cleaning and Inspection

- Professional detail inside and outside

- Inspect and repair any water damage or leaks

- Check all mechanical systems (brakes, lights, couplers)

- Document any needed repairs with cost estimates

Week 2: Minor Repairs and Improvements

- Fix small issues that create negative first impressions

- Replace worn hardware and accessories

- Touch up paint and seal any gaps

- Ensure all appliances function properly

Week 3: Documentation and Photography

- Gather all maintenance records and manuals

- Take high-quality photos showcasing key features

- For off-road trailers, highlight suspension, ground clearance, and adventure capability

- Create a comprehensive feature list

Week 4: Pricing and Marketing Strategy

- Research comparable listings on RV Trader, Facebook Marketplace, and local dealers

- Price competitively for current market conditions

- Prepare marketing materials highlighting unique features and maintained condition

Pricing Strategy for Current Market

Use multiple valuation sources:

- J.D. Power RV Values for baseline estimates

- NADA Guides for industry standard pricing

- Local market comparison through active listings

- Seasonal adjustment for timing advantages

In the current softer market, price slightly below comparable units to generate faster interest and multiple inquiries.

Sales Channel Selection

Private Sale Advantages

- Higher selling prices compared to trade-ins

- Direct buyer interaction for feature explanation

- Flexibility in negotiation and timing

Consignment Options

- Professional presentation and marketing

- Dealer licensing for financing assistance

- Reduced time commitment for sellers

Trade-In Considerations

- Convenience and immediate transaction

- Lower net proceeds but simplified process

- Tax advantages in some states

Case Study: Depreciation Scenarios

Example: $60,000 Off-Road Travel Trailer

Let’s examine two identical trailers purchased for $60,000, with different maintenance approaches:

Well-Maintained Trailer (Scenario A)

- Year 1: $48,000 (20% depreciation)

- Year 3: $42,000 (30% total depreciation)

- Year 5: $36,000 (40% total depreciation)

- 5-year retained value: 60%

Poorly Maintained Trailer (Scenario B)

- Year 1: $45,000 (25% depreciation)

- Year 3: $36,000 (40% total depreciation)

- Year 5: $27,000 (55% total depreciation)

- 5-year retained value: 45%

The $9,000 Maintenance Difference

This example illustrates how proper maintenance can preserve $9,000 in value over five years – often exceeding the total cost of preventive maintenance during that period.

Upgrade Impact Analysis

Popular upgrades that enhance resale value:

- Solar power systems: $2,000-4,000 investment, $1,500-2,500 value retention

- Lithium battery upgrades: $1,500-3,000 investment, $1,000-2,000 value retention

- Premium tires: $800-1,200 investment, $500-800 value retention

Understanding Market Segments and Buyer Types

Family Recreation Market

- Seeks reliability, space, and convenience features

- Values brand reputation and dealer support

- Price-sensitive but quality-conscious

Adventure/Off-Road Enthusiasts

- Prioritizes capability and durability over luxury

- Willing to pay premiums for proven performance

- Values modification potential and parts availability

Full-Time/Extended Living

- Focuses on comfort, storage, and long-term reliability

- Scrutinizes construction quality and warranty coverage

- Considers total cost of ownership including maintenance

Weekend Recreation Users

- Balances price and features for occasional use

- Values ease of storage and towing

- Often upgrades as family needs change

Regional Market Variations

Sunbelt Advantages

States like Arizona, Texas, and Florida maintain year-round RV activity, supporting stronger resale markets and less seasonal price variation.

Northern Climate Considerations

Areas with harsh winters may see accelerated exterior wear and seasonal demand patterns that affect timing strategies.

Off-Road Hot Spots

Regions near national parks, BLM lands, and off-road recreation areas show stronger demand for capable trailers like BlackSeries models.

FAQs

How fast do travel trailers depreciate in the USA?

Travel trailers typically lose 15-25% of their value in the first year, then depreciate 5-10% annually. Quality brands and proper maintenance can significantly slow this rate.

Which travel trailer brands have the best resale value?

Airstream leads resale value retention, followed by established manufacturers like Winnebago, Forest River, and Jayco. Specialty off-road brands like BlackSeries serve niche markets with strong demand.

Do off-road travel trailers like BlackSeries hold value better?

Yes, off-road trailers often retain value better due to specialized construction, smaller production volumes, and dedicated buyer communities willing to pay for proven capability.

What is a good resale price for a 5-year-old travel trailer?

A well-maintained 5-year-old travel trailer from a quality brand should retain 55-65% of its original purchase price, depending on condition, brand reputation, and market demand.

How can I increase my trailer’s resale value before selling?

Focus on thorough cleaning, minor repairs, complete maintenance documentation, quality photography, and competitive pricing based on current market conditions.

Is now a good time to sell a used travel trailer in the U.S.?

The current market favors buyers with increased inventory, but quality trailers priced appropriately still sell well. Early spring typically offers the strongest seller’s market.

Do solar panels and lithium batteries improve resale value?

Yes, these upgrades typically retain 50-75% of their installation cost in resale value, especially appealing to buyers interested in off-grid camping capabilities.

The travel trailer resale market rewards informed sellers who understand depreciation patterns, maintain their units properly, and market strategically to appropriate buyer segments. Whether you own a mainstream family trailer or a specialized off-road unit like BlackSeries, following these guidelines will help maximize your return on investment.