Table of Contents

In the USA, travel trailer financing is typically available through banks, credit unions, RV lenders, and dealer financing with common down payments of 10-20% and loan terms spanning 5-15 years (sometimes up to 20 years). Interest rates vary significantly based on credit score, debt-to-income ratio, and down payment size. For premium off-road trailers like Blackseries, a reasonable down payment combined with good credit records can substantially reduce monthly payment pressure.

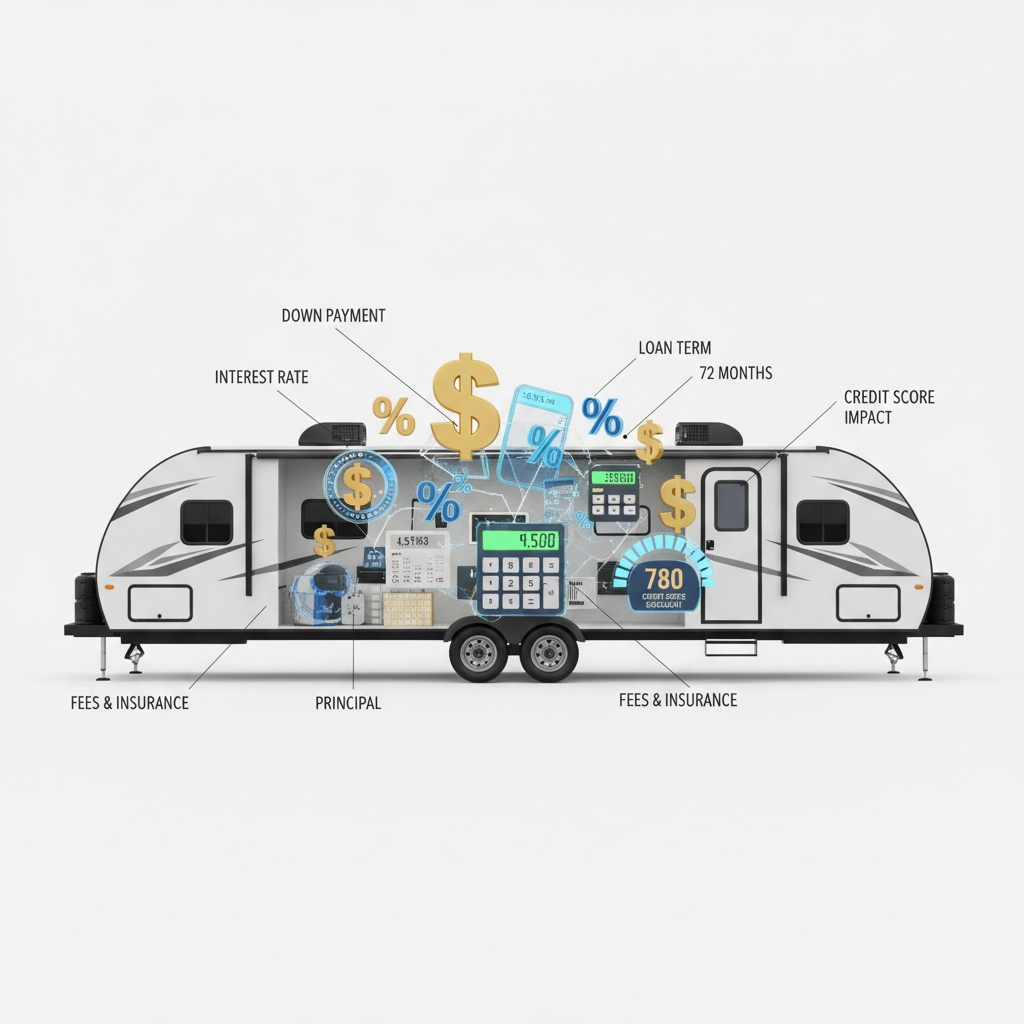

How Financing a Travel Trailer Works in the USA

Understanding travel trailer financing starts with recognizing the different loan types available to American buyers. Unlike standard auto loans, RV loans are specifically designed for recreational vehicles and travel trailers, offering longer repayment terms that can extend from 5 to 20 years depending on the lender and loan amount.

RV Loan vs Auto Loan vs Personal Loan

RV loans are purpose-built for recreational vehicles, including travel trailers, with extended terms of 10-20 years and moderate interest rates. These loans treat your trailer as collateral, which typically results in better rates than unsecured options.

Auto loans may be applied to smaller travel trailers by some banks, but these typically come with shorter terms (3-7 years) and may have stricter requirements regarding the trailer’s age and value.

Personal loans offer the most flexibility since they’re unsecured, but come with higher interest rates and shorter repayment periods, making them suitable primarily for smaller loan amounts or gap financing.

Secured vs Unsecured RV Loans

Most travel trailer financing uses secured loans, where the trailer itself serves as collateral. This arrangement provides lenders with security, resulting in lower interest rates for borrowers. If payments aren’t made, the lender can repossess the trailer.

Unsecured loans rely entirely on your creditworthiness and don’t require the trailer as collateral. While this eliminates repossession risk, it typically means higher interest rates and stricter qualification requirements.

Average Interest Rates for Travel Trailer Loans in the USA

Interest rates for travel trailer financing in 2025 vary considerably based on your credit profile and loan terms. Current market conditions show rates ranging from approximately 6% for borrowers with excellent credit to over 15% for those with poor credit histories.

Interest Rate Breakdown by Credit Score

Factors Affecting Your Interest Rate

Credit score (FICO) remains the primary factor, with each tier representing significant rate differences. A jump from fair to good credit can save thousands over the loan term.

Debt-to-income ratio (DTI) should ideally stay below 40-45% including your new trailer payment. Lenders view lower DTI as reduced risk.

Down payment size directly impacts rates – larger down payments often unlock better interest tiers and demonstrate financial commitment to lenders.

New vs used trailers can affect rates, with some lenders offering slightly better terms for new units due to known condition and full warranty coverage.

RV Loan Requirements for Travel Trailers in the USA

Meeting qualification requirements is essential for securing favorable financing terms. Most lenders maintain similar baseline requirements, though specific criteria can vary significantly between institutions.

Basic Qualification Requirements

Legal residency and age requirements mandate that you’re at least 18 years old (21 in some states) with legal U.S. residency status. Most lenders require documentation proving your current address and immigration status if applicable.

Stable income verification typically requires recent pay stubs, tax returns, and bank statements. Self-employed borrowers may need additional documentation, including profit and loss statements.

Minimum credit score requirements generally start around 620-640 for most mainstream lenders, though some specialty lenders work with scores as low as 575.

Acceptable debt-to-income ratio usually caps at 40-45%, including your prospective trailer payment, insurance, and storage costs.

Vehicle-Specific Requirements

Trailer age limits vary by lender, with some refusing to finance units older than 10-15 years. This particularly affects buyers looking at used premium trailers.

Loan amount thresholds typically range from $15,000 minimum to $500,000 maximum, though most travel trailers fall well within these bounds.

Purchase source requirements can affect approval, as some lenders prefer dealer purchases over private party transactions due to additional consumer protections and easier title transfers.

Special Considerations for High-End Off-Road Trailers

Premium off-road trailers like Blackseries models often require special consideration from lenders due to their higher price points and specialized construction. When financing a premium off-road trailer, lenders may:

- Require larger down payments (20-25%) due to higher unit values

- Request additional documentation about intended use and storage

- Consider the trailer’s construction quality and durability in their assessment

- Evaluate whether specialized insurance coverage will be maintained

How to Get Pre-Approved for a Travel Trailer Loan

Pre-approval provides significant advantages in the trailer buying process, giving you negotiating power and budget clarity before you start shopping.

Step-by-Step Pre-Approval Process

1. Check Your Credit Report and Score

Obtain free credit reports from all three bureaus and verify accuracy. Address any errors before applying, as these can significantly impact your approval odds and interest rates.

2. Calculate Your Budget Parameters

Determine your comfortable monthly payment, available down payment, and realistic total budget. Include insurance, registration, storage, and maintenance costs in your calculations.

3. Compare Multiple Lenders

Research banks, credit unions, specialized RV lenders, and online platforms. Credit unions often provide competitive rates for members, while specialized RV lenders understand trailer values better than general-purpose banks.

4. Submit Pre-Approval Applications

Most lenders offer online pre-approval with soft credit pulls that won’t impact your score. Apply to 3-5 lenders within a 2-week window to minimize credit inquiries’ impact.

5. Review and Compare Offers

Evaluate not just interest rates, but also fees, terms, prepayment policies, and customer service quality. The lowest rate isn’t always the best deal if fees are excessive.

Pre-Approval Benefits

Pre-approval transforms you from a “maybe” buyer into a serious purchaser with verified financing. This status strengthens your negotiating position, helps you stay within budget, and speeds up the purchase process once you find your ideal trailer.

Financing a Travel Trailer with Bad Credit

While challenging, financing options exist for buyers with credit scores below 620. Success typically requires a strategic approach and realistic expectations about terms and rates.

Strategies for Bad Credit Financing

Increase Your Down Payment

Larger down payments (25-30%) reduce lender risk and can compensate for lower credit scores. This approach also reduces your monthly payments and total interest costs.

Consider a Co-Signer

A co-signer with good credit can unlock better rates and terms. However, both parties share full responsibility for the debt, making this a significant commitment.

Focus on Credit Improvement

If possible, delay your purchase to improve your credit score. Paying down high-interest debt, correcting credit report errors, and maintaining consistent payment history can boost your score significantly in 6-12 months.

Explore Alternative Lenders

Some lenders specialize in bad credit financing, though rates will be higher. Peer-to-peer lending platforms and credit unions may offer more flexible qualification criteria.

Important Note: Avoid taking on debt you cannot comfortably afford. High-interest financing can lead to financial stress and potentially losing your trailer to repossession.

Best Financing Options for Travel Trailers

Different lenders serve different needs, and the “best” option depends on your specific situation, credit profile, and the type of trailer you’re purchasing.

Lender Type Comparison

Top Performers in Travel Trailer Financing

Credit unions consistently offer some of the most competitive rates for qualified members. Navy Federal Credit Union, for example, provides rates starting around 7.45% for terms up to 180 months.

Specialized RV lenders like Good Sam Finance understand trailer values and offer terms tailored to RV ownership, including seasonal payment options and extended warranty integration.

Regional banks with RV lending programs often provide personalized service and competitive local market rates.

Down Payment Requirements and Benefits

Down payment amounts significantly impact your loan terms, monthly payments, and total borrowing costs. Understanding optimal down payment strategies can save thousands over your loan term.

Standard Down Payment Expectations

Most lenders expect 10-20% down payments for travel trailer financing, though requirements vary based on credit quality and loan amount. Premium trailers often see higher down payment requirements due to their specialized nature and higher values.

Down Payment Impact Analysis

Using a $70,000 Blackseries trailer as an example:

Higher down payments provide multiple benefits: lower monthly payments, reduced total interest costs, better loan terms, and decreased negative equity risk.

Understanding Total Financing Costs

Monthly payments represent just one component of your total financing costs. Understanding all expenses helps you budget accurately and compare offers effectively.

Complete Cost Breakdown

Principal and interest form your basic monthly payment, but additional costs include:

Loan fees such as origination fees (typically 1-2% of loan amount), documentation fees, and credit report fees can add hundreds to thousands to your total cost.

Insurance requirements typically mandate comprehensive and collision coverage, which can be substantial for high-value off-road trailers due to their specialized use and higher replacement costs.

Registration and taxes vary by state but can represent significant upfront costs, especially for expensive trailers.

Extended warranty and gap insurance may be optional but worth considering for premium trailers with complex systems and higher values.

For off-road capable trailers like Blackseries models, insurance costs may be higher due to their intended use in remote areas and higher replacement values, making it important to factor these costs into your total budget.

Special Financing Programs and Incentives

Many manufacturers and lenders offer special financing programs to qualified buyers, particularly during slower sales periods or for inventory management.

Manufacturer Financing Programs

Some manufacturers offer captive financing through partnerships with major lenders, potentially providing promotional rates or extended terms for new purchases.

Seasonal Programs

RV financing often includes seasonal considerations, with some lenders offering payment deferrals during off-season months when the trailer isn’t being used.

Trade-In and Upgrade Programs

Many dealers and manufacturers offer streamlined financing for customers upgrading from existing RVs, potentially rolling existing loans or providing trade-in value credits.

Frequently Asked Questions

What credit score do I need to finance a travel trailer in the USA?

Most lenders prefer credit scores of 620 or higher, though some specialized lenders work with scores as low as 575. Better credit scores unlock significantly better rates and terms.

What are typical interest rates for travel trailer loans right now?

Current rates range from approximately 6-8.5% for excellent credit to 15%+ for poor credit, with most qualified buyers seeing rates between 7-12% depending on terms and down payment.

How long can you finance a travel trailer for?

Loan terms typically range from 5-20 years, with longer terms available for higher loan amounts. Extended terms reduce monthly payments but increase total interest costs.

Do RV loans require a down payment?

Most lenders require 10-20% down payments, though some programs offer zero-down financing for qualified buyers. Larger down payments typically result in better rates and terms.

Can I finance a used travel trailer or only new ones?

Both new and used trailers can be financed, though lenders may have age restrictions (typically 10-15 years maximum) and may offer slightly different terms for used units.

Is it harder to finance an off-road travel trailer like a Blackseries?

Premium off-road trailers may require larger down payments and specialized lenders familiar with their values, but their quality construction and strong resale values often work in buyers’ favor during the approval process.

Should I get pre-approved before visiting a dealer?

Pre-approval is highly recommended as it provides negotiating power, helps you stay within budget, and speeds up the purchase process. It also allows you to compare dealer financing against your pre-approved terms.